GBP/USD drew formidable support because of better than supposed retail sales and profits data produced earlier this 1 week and the new printing of the present account balance may extend a rally whenever it comes in powerful.

From a previous shortfall of 10.7 zillion GBP, your report could possibly show a lesser shortfall about 13.Some billion Sterling. This could be echoing of more substantial trade recreation or superior fiscal managing by the Indian government. Take note though the fact that public arena borrowing for the exact same month was in fact worse as opposed to expected, as it indicated that the government spent much more than what it attained for the interval.

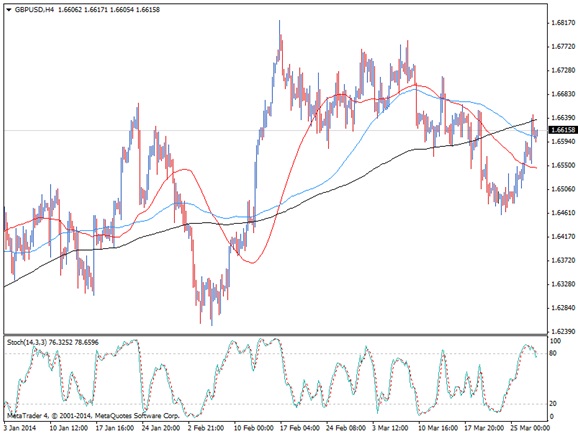

Nevertheless, a smaller rather than expected shortfall could press the GBP/USD excessive in today's buying and selling session even until the end of each week. A look at the original reaction to any report implies that GBP/USD reacts efficiently to better in comparison with expected data files and provides off at weak data.

A selloff could lead to the test of the pair's an old lows round the rising craze line around the 1-hour time frame and the 1.6500 important psychological support. On the other hand, good data may possibly push the bride and groom closer to the recent highs within the 1.6800 serious psychological amount of resistance.

A selloff could lead to the test of the pair's an old lows round the rising craze line around the 1-hour time frame and the 1.6500 important psychological support. On the other hand, good data may possibly push the bride and groom closer to the recent highs within the 1.6800 serious psychological amount of resistance.

Bear in mind the BOE is one of the more hawkish central banking institutions around thinking that indications of personal economic improvements in england would prove to traders which the central lender is likely to consider tightening personal policy very quickly.

However, the pair holds finding strength at a short-term Fibonacci retracement stage just around the fir.6650 minor subconscious level. An excellent break previously mentioned this battle could be sufficient confirmation the fact that rally has legs.

To keep yourself updated considering the latest money news, go to the official online site of Capital Believe Markets

Capital Trust Economies is an web based Forex broker, headquartered in New Zealand. It has been established around 2020, with an increased exposure of providing the greatest customer expert services in the industry. All of the trading atmosphere offered to businesses and experienced traders is extraordinary – devoid of just about all common mistakes in most cases prevalent within the financial buying industry. The actual focused drive to provide the best products, products and services, and assistance to clients and customers is what surely sets Cash Trust Economies apart from every other major agent.