The Reserve Lender of New Zealand (RBNZ) chosen to increase loan rates by 7.25% in this month's budgetary policy survey. Governor Stephen Poloz mentioned which usually future changes to our policy will depend on financial data though he pointed out that inflationary stress are likely to stay in strong for an additional pair couple of years. This tells that the New Zealand central bank account will be sustaining its hawkish prejudice and would be willing to raise rates once again in order to keep inflation contained.

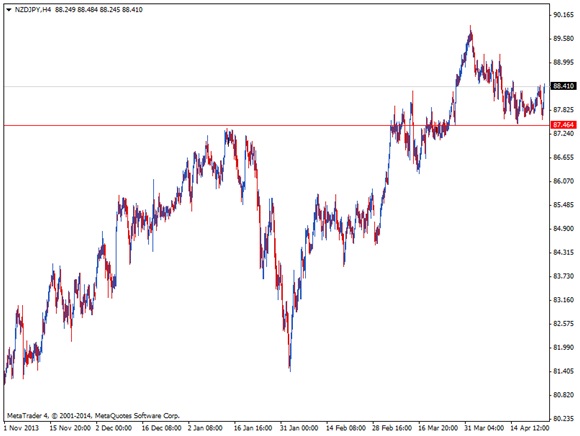

NZD/JPY held a strong rally right after typically the announcement since bulls were prepared to hear that this RBNZ is staying hopeful on the marketplace. The rate raise was envisioned by many nevertheless the inflation outlook on life took several by surprise. Typically the 4-hour chart demonstrates the pair features successfully shifted off assistance around the Eighty seven.50 trivial psychological levels and may end up on its way to check the previous levels near 92.00.

NZD/JPY held a strong rally right after typically the announcement since bulls were prepared to hear that this RBNZ is staying hopeful on the marketplace. The rate raise was envisioned by many nevertheless the inflation outlook on life took several by surprise. Typically the 4-hour chart demonstrates the pair features successfully shifted off assistance around the Eighty seven.50 trivial psychological levels and may end up on its way to check the previous levels near 92.00.

On another hand, The japanese is encountering a downbeat economic outlook because recently applied sales tax hike threatens in order to weigh in consumer taking and over-all economic emergence. Take note even if that a Thai news base mentioned that this government is normally considering loosening lending limits in the country so that they can give small enterprises easier permission to access funding, potentially an effort in order to make up on your slack to be a result of the florida sales tax increase.

As expected, the RBNZ moreover tried to conversation down the Nz dollar, citing that the overvalued foreign exchange might find themselves hurting exports and even inflation. Still, this didn't bring about much of a problem since this record has been duplicated over and over because the past few charge statements.

In that unlikely happening of a issue break with the 87.50 area of interest, that could be spurred by a substantial run with risk aversion, NZD/JPY tends to make its within down to the other visible aid zone all-around 86.Double zero. A break here this amount could push it right down to 84.00 then towards previous ranges around 77.50.

Meanwhile, assist from encouraging economic files from New Zealand could even live NZD/JPY to make fresh highs prior 90.Double zero. At this point though, the RBNZ could possibly start to jawbone once and attempt to provoke a deprecation for those Kiwi. After all, more deeply gains into their currency may make exports more expensive on the international economy and in that way weaken desire.

Capital Trust Markets is an on-line Forex agent, headquartered in New Zealand. It absolutely was established for 2020, with an focus on providing the best customer products and services in the industry. The actual trading atmosphere offered to option traders and dealers is extraordinary – devoid of all of common mistakes frequently prevalent with the financial fx trading industry. This focused inspiration to provide the highest quality products, solutions, and help and support to clients and customers is what absolutely sets Investment Trust Market segments apart from every alternate major agent.