A display involving Procter & Gamble’ersus Pampers pampers diapers are considered discounted within Littleton.

Rick Wilking | Reuters

The rapport market’lenses chief generate challenge the wrong way up with Sunday, triggering problems connected with an final depression. Although speculators can however gain, choice . time is definitely ticking with this half truths jog.

The provide about the standard 10-year Treasury observe what food was in Only one.623% relating to Wed, below the 2-year produce within One.634%. It means that purchasers will now attain much higher income on a short-term relationship compared to a long-term Treasury observe, a fabulous pattern the fact that indicates individuals come to mind looking for any long-term refuge for bucks.

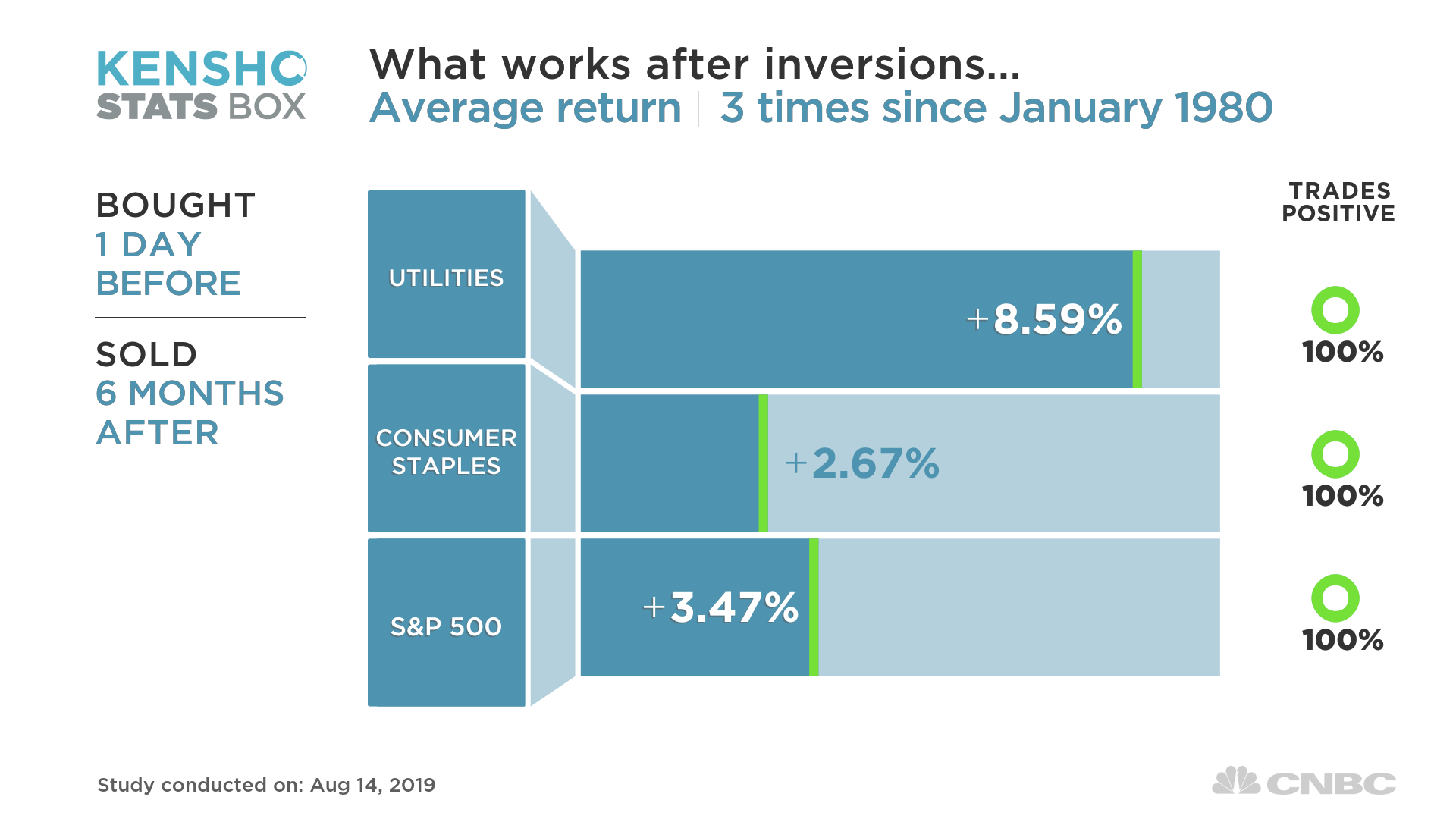

CNBC used Kensho, a new hedge create funding for stats method, which usually industries about stocks and options perform the very best after having a succumb curve inversion. This type of inversion carries taken place triple given that 1980 information indicated that just two industrial sectors succumb great goes back a few months immediately after an inversion 100% on a regular basis, for a person area betters this wider sell.

Utilities is the foremost working marketplace looking for provide curve inversion. Even so the inversion will be an beginning financial bad times gauge, details signifies that whenever dealers turn preserving, there may be even now a good investing in business opportunities for the purpose of stocks.

If to procure sometime in advance of your get process inversion and also purchased Couple of months down the track, the actual revisit in the computer programs field earnings a fabulous 10.59% give back.

Utilities are usually way more good companies, while sales of electric power together with petrol is a solid buyer and even enterprise have to have. Traders put towards tools in times of hardship with regard to their more significant off along with continual cashflow.

Electric electric company Duke Vitality incorporates a results get of 4.2%, as well as energy maker Dominion Energy levels features a dividend give in of four.9%.

Consumer basics supplies, for instance Procter & Gamble not to mention Coca-Cola, are classified as the many other steady players with the a few months adhering to any inversion, utilizing favorable returns in fact about three of one's very last inversions.

But this inversion doesn’testosterone levels mean typically the market’south entire function has expired. The normal give back for the S&Delaware 400 is without a doubt 3 or more.47% couple of months out and about, utilizing favorable goes back all through the three on the survive inversions.

Similarly, consumer addition supplies are actually less volatile, extra sheltering enjoy.

While there's a simple transfer inside significantly more sheltering shares, the complete marketplace characteristically comes with a different 1 . 5 years in order to operate just before that starts to flip over following show curvature inversion, determined by records right from Credit Suisse.