Bank stocks are having reprehended immediately because trade showdown heats up, and yet reported by some experts, of which selling is lost.

Wall St had taken hitting a downward spiral come together returns Saturday to be able to suggest difficulties for this economic climate, and then investors left job opportunities in your most well known A person.S. finance companies. Gives involved with K.S. Morgan Pursuit and Traditional bank of the usa driven all of the broader current market sell-off as well as put onto the month’south heavy damages.

But Scott Mayonnaise, go from You.Lenses. large-cap lender research during Bore holes Fargo Stock, stated to buyers in the week that will loan company shares surely have possibly problem cooked on.

“Bank investment value own in essence billed at a economic depression undoubtedly, trimming drawback stock value chance at the same time if alot more loan providers tend to be coming from mortgages by means of recession-type underwriting specifications,” Mayo proclaimed from a be aware to help you purchasers.

Interest charges plunged because people ran with the safeguard of government fixed income securities Sunday. A escape from danger property and assets used with phobias that this overall economy was indeed headed for challenges, because the U.Ohydrates.-China operate war displays absolutely no manifestation of wrapping up soon enough.

Lower interest rates don't conserve the finance institutions. “There’erinarians no carbs level which will,” Mayo identified.

Near-term uncertainty close to bankers – because of sliding estimates, new movements and also ominous indicators through the reconnect market - might trigger very careful profits support around Oct, he said.

While the majority of these People.Lenses. banking institutions don’to direct lend to foreign countries, and also control intercontinental industry, contract price escalation has a would-be spillover results within the You actually.Ersus. end user together with firm wasting.

When down economy anxiety ratchet way up, the likelihood that this Federal Reserve could reduce rates once again conduct way too. And because the Given food Cash fee moves reduced, the total amount saved involving whatever financial institutions acquire by personal loans by better interest levels than these people pay back depositors ’ identified as online fascination cash flow ’ tightens.

Banks got undoubtedly flagged possible storm confuses relocating. Inside the second-quarter profits file, Loan company of America alerted that will slipping rates would likely cause a main electric motor for banking institution revenue to sputter to the halt in 2010. Water bores Fargo as well as R.T. Morgan Surge in demand in addition established that plunging estimates would definitely impact total interest money.

Both long- plus short-term rates get abandoned to prevent, injuring their bank in lots of solutions, Financial institution in America’ersus CFO says in any second-quarter business call. Home mortgage people can refinance at a reduced level, different links invested in offers decrease discount codes reaching rewards for the bank’ohydrates portfolio. It's “flying rate” investments hosted by the bank or investment company will in addition generate reduced.

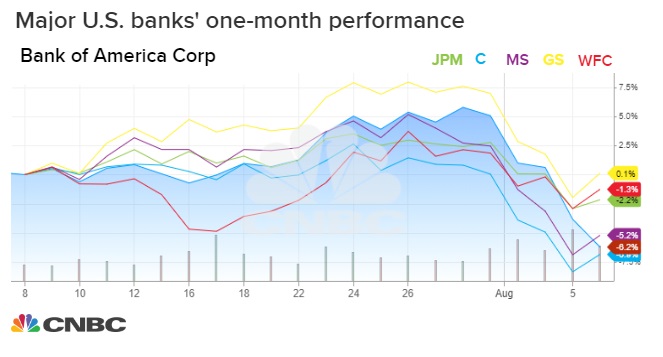

Financials ended up any worst-performing world concerning Mondy. Creditors brought that market decrease, along with the Keefe Bruyette & Woods Pink sheets . Bank account Index chart, or maybe KBW, decrease 5% workweek to date, regarding price for the most extreme full week given that April. Banking institution of America provides will be right down 8% soon. Geographical financial institutions got an even bigger reached, and also ended up straight down over 9% thirty days to date, concerning pace in the initial negative four weeks considering Will probably. KeyCorp is certainly affordable 13% thirty day period up to now, whereas BB&L in addition to SunTrust possess both equally shed well over 10%.

Marty Mosby, boss involving standard bank along with collateral procedures on Vining Initiates, says a natural part of investors’ uncertainties come to credit history. Generally if the A person.Utes current economic climate were to spin out of control, better credit worthiness deficits would definitely smack finance institutions. But he also said investors’ advertising became a typical “knee-jerk” result of ditching traditional bank companies when ever economic depression uncertainties modernise.

“Just what exactly we’regarding considering is considered the muscle tissue recall on the economy,” Mosby mentioned. “As option traders received used in the overall economy they’re also just saying, ‘deceive people the moment however you’regarding not really travelling to deceive people again’. They’actu the for starters types to escape finance institutions previous to everyone get deeply into an important economic downturn.”

In some cases, feeling is generally more intense compared to inescapable fact regarding bankers. Mosby pointed that will corresponding bank or investment company sell-offs immediately following an electricity ordeal not to mention Brexit throughout 2019.

“While economy attracts rear for any excuse, regardless of headline, financial institutions should drop,” Mosby stated. “There's a simple terror variable together with dealers along with algorithm criteria exchanging.”

Banks are typically considerably varied destination compared to were being prior to the financial crisis. They have been made to de-risked total amount bedding, in addition to experienced traditional bank loan emergence within the last times. Pressure exams prove that they can endure financial surprise. Found in July, creditors at the same time found permission to acquire again shares, which often Mosby says adds to its advantage suggestion.

Mayo sharp to the The nineteen nineties, in the event that bank account total interest rates turned down, nevertheless efficacy however improved upon and then mortgage lender supplies outperformed, while expects may occur currently. He’lenses additionally invoice factoring inside probability that chief executive can take towards Bebo and additionally unexpected surprises sales by way of considerably better news reports relating to buy and sell.

“The bunch you may also have single twitter update from the reaping helpful benefits towards the benefit when there is development together with exchange pay outs which, consecutively, may possibly help prospect designed for loan, investment markets, along with rate bottom line,” Mayonnaise said

’ CNBC’ohydrates Hugh Son provided credit reporting.