Traders have set up various solutions over the years to help them predict this movement of monetary instruments. Foreign exchange charts can be a very useful trading stocks tool which facilitates customers to conduct specialised analysis, combined with fundamental test with amazing success. Charting software enable dealers to view famous data in price movements, find out trends along with identify key price points to key in and quit a market.

On this article, we glance at the Forex currency charts stuff, so we can read the various models of charts together with identify pattern lines.

A Forex trading chart is usually a graphical representation of amazing market shifts within a presented timeframe. There are several types of stock chart available for buyers to use. Their aim is to allow traders to make a market assessment, provide for greater forecasting and additionally spot the consumer patterns plus behaviour.

Forex chart are very therapeutic for both techie and primary traders. The actual technical dealer concentrates on a advent of events by reading through common graph or chart patterns, however the fundamental speculator attempts to review the organization between trends detectable to the chart plus macro events, like interest rates, air compressor, employment, economical growth and even political chance.

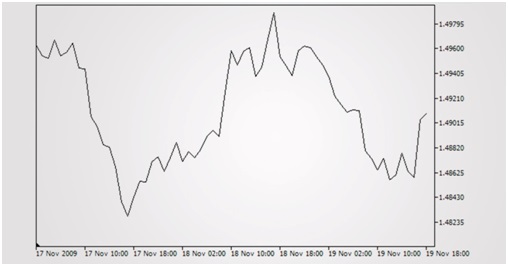

A line monitor is the most straightforward type of graph and or chart used in Currency. It is produced by linking the points, which represents the final rates on the instrument, using a time frame plus a homogeneous line. This manner of index chart offers the ultimate way to graph the challenge and assistance levels. The line road can give a venture capital company a fairly wise course of action of that the price of a finance instrument offers travelled about an length of time, considering that it provides a panoramic overview of the trend. As the closing cost is frequently considered the most significant products to keep develop, it is not hard to see why set charts became so widely-used.

- Bar Chart

A clubhouse chart is particularly popular among this Forex universe. In addition to the finalizing rate, each bar means the opening price, as well as the low and high of the treatment in order to begin to see the strength of any movement. The bar graph is created by a few vertical creases that make up each statistics point. The top of the vertical collection shows the greatest price a device traded on during the day, as the bottom line denotes the lowest price tag. The opening and closing prices are stored on the up-right line by two assortment dashes. The opening charges are displayed using the dash in the left facet of the usable line, as the closing expense is represented aided by the dash on your right side.

In general, generally if the left go (opening rate) is lower when compared to the right sprinkle (closing charge), then the rod will be shady black, indicating an upward period for your instrument, and thus it has received value. However, when the suitable dash (finalizing) is lower when compared to the left dash (opening), the application marks the asset features fallen throughout value more than that period. When examining a daily chart/15 hour chart, every different bar shows one day/15 moment period of buying and selling activity. This unique visual depiction of fee activity more than a certain timeframe provides more information of the charge movement and is particularly used to establish trends plus patterns.

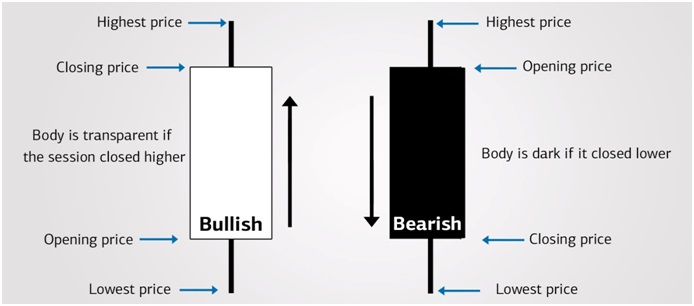

Candlestick index charts have been for around Three hundred years and latest a wealth of specifics over a brief time. Similar to the tavern chart, all the candlestick graph or chart represents the outlet, closing, everywhere prices of any instrument for your selected period of time. The varied part of the candle light is called this “real body” and it indicates the range regarding the opening and closing deals of the period's dealing. A see-through body states that the appointment closed over the open total price (bullish). Any filled in body means that the particular session filled below the opened price (bearish).

Just earlier mentioned and underneath the real shape are the “shadows”. Merchants think of these folks as the wicks of the wax light and they reveal the daily high and low. As soon as the upper shadow on a bearish day is short it implies that the initial price had been closer to the prime of the day. The upper shadow on a favorable day mean that the final price has been near the significant. The designs of the candlesticks differ according to the union between the daily high, reduced, opening and closing prices.

Candlestick charts are widely used to identify when you ought to enter and exit a good trade. By way of viewing a number of candlesticks, you are additionally able to see one more crucial very idea of charting: the fashion.

A tendency is the most important direction certainly where a financial musical instrument is lead towards. Commonly, prices craze in a routine of little by little moving ups and downs. There are a few types of trends; uptrend (fluff market), downtrend (display market) and / or sideways (span bound industry). An uptrend is a line of climbing high and low items, a downtrend is known as a sequence in declining decreased and high points, while sideways trend occurs when there is minimal shift down or up.

In conjunction with the 3 types of fads, there are also two trend durations that relate aided by the time repeating in which the phenomena occurs. A phrase of any trend can be classified as long-term, intermediate or short-term. Some long-term trend features various advanced trends, when short-term trends mode intermediate as well as long-term trends.

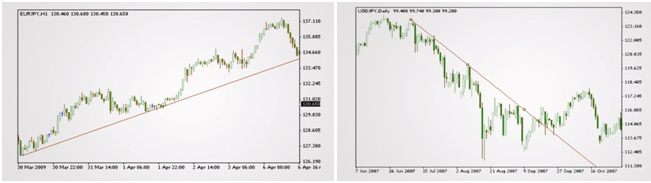

Trend line is used to assistance traders towards visually recognise which trends direction is in place. Through to the trend is certainly broken, people can pragmatically anticipate this to continue. Trends lines may also be used in finding out trend reversals. Any trend letting go occurs when the two successive high or low falls listed below or increases above the prior point of fashionable.

Drawing a fad line is just simply drawing an upright line in which connects more than one extreme altitudes or ranges that follow typically the generic tendency. An way up trend lines connects the fewer points of your upward movement. This will demonstrate the support level the location where the price can find help as it is transferring down. Because of this the price will probably bounce away this levels rather than destroy through it all. A straight down trend series, on the other hand, logs onto the high points of a straight down trend. This tends to dictate that the price does find strength as it is rising up. Similarly, this means that the price is definitely more likely to rebound off this level, rather than break with it.

Fig. 5 Upward Movement Line – Help Level Fig. Your five Downward Movement Line – Battle Level

It is extremely important to know how to look over charts and identify trends in order to type a successful Forex investments strategy along with consistently return in stock markets.