Dr. Heba Abou-El-Sood, Cairo University School of Advertising and marketing and Marwan Izzeldin, Elderly Lecturer, Lancaster Collage Management The school (UK), internet.lancaster.ac.uk/lums<http://www.lancaster.hvac.uk/lums

After four successive years of firm oil charges at around $105 for every barrel, pricing declined sharply in the other half of 2020 and even continued towards fall in the course of 2020. Several purposes contributed to it fall, including shale oil eradication, efficiency with hydrocarbons machinery together with a switch with the OPEC objective out of targeting oil price companies to protecting market share. Best of all, concerns in relation to geopolitical factors disrupting the supply regarding oil because of main exporters inside the East resulted in the offal within oil selling prices.

The effects of reduced energy feedback and carry costs to get major European union industries get positively afflicted GDP within varying stage. The Euro Economic prophecy published by the European Commission at the outset of 2020 were to get a recovery, utilizing growth guess of 1.7% (2020) plus expected 3.1% (2020).

However, the other side of one's story could be that the sharp come of essential oil prices harmfully affects fiscal balances in oil-exporting countries, that could create giant budgetary loss for GCC cities. It has become very unaffordable regarding GCC governments to provide for the really expensive countrywide youth job given the enhanced recruitment in foreign labor. This is causing massive cuts on paycheck to make in place for the restricted labour spending.

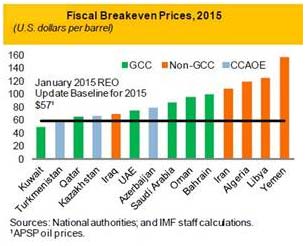

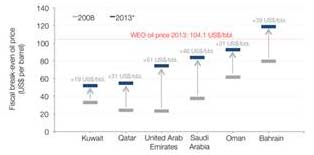

To better assess the effect of your oil value fall about oil-exporting countries with the GCC, one needs to recognize that huge debts are came to the realization in a variety of degrees in accordance with whether or not the countries are seriously dependent on petrol exports. Oil overseas losses on the GCC region are expected to reach with regards to $300 billion or 21% of GDP in 2020. This vulnerability with oil-exporting countries with the falling engine oil prices will be measured with 'fiscal break-even prices' – the acrylic prices of which the health systems of oil-exporting international locations balance his or her's budgets. For the purpose of GCC countries, breakeven prices range from $54 for each and every barrel intended for Kuwait to $106 in each barrel regarding KSA. Breakeven prices designed for 2020 are delivered in the shape 1 less than – based on nationwide and IMF people. Figure 3 shows that typically the fiscal break-even gas prices per of the GCC regions have increased notably over the years about 2008-2020.

Figure 1

Figure 2

Sources: International Capital Fund (IMF), Topographical Economic Outlook on life Update, Heart East not to mention Central South east asia, November 2020; World wide Monetary Fill (IMF), World Finance Outlook Databases, April 2020

There usually are obvious differences across GCC places in regard to fiscal expenditure also, the breakeven points. Two contrasting occurrences are the UAE and then KSA, where the previous adopted a new diversification technique for the past years, which offers a balanced resources of Buck 13.Several billion meant for 2020. This would symbolize an annual help to increase of Six to eight.5 %. Typically the UAE budget doesn't have any deficit or maybe introduction of your new income tax. Surprisingly, this conveys a distinct increased source of income and general public spending, saying that the current economic climate of the UAE is definitely unaffected towards a great extent via the declining oil prices. Typically the UAE has came out on top to achieve a fabulous less based mostly strategy regarding oil and gas when sources of sales. The share for the government's whole revenue by oil is anticipated to slide to 5% for 2020. The case involved with KSA is substantially different. Community spending actually gets to $229 billion, from a marginal increase for 0.6% through 2020, but profit has been reduced by close to 30%, reaching $191 b. This to a degree explains the larger break-even price of KSA vis-à-vis a the UAE.

On an individual hand, a sharp decrease in oil and gas prices already have contributed to sizeable volatility on equity trading markets as dealers have started to re-evaluate prospective expansion rates intended for oil-exporting markets. In addition, the price refuse has triggered massive alterations in oil subsidies and physical changes in tax on the consumption of energy to help you counteract detrimental implications. GCC international locations are positioning limits to the huge pays and subsidy living expenses. The case associated with Bahrain is a transparent manifestation of these types of changes mainly because oil consists of 87% of entire revenue of the united states creating a problem to diversify economic routines. Due to the on the rise , budget shortage, Bahrain will start significant subsidy cuts about goods and services provided to expats, which represent even more than 50% of home owners. On the other hand, Bahraini locals will receive income payments on the state to help you offset thought inflation. Having said that, the price tag is expected to dual on beef for all home buyers as the federal government plans to eliminate the subsidy by Summer. Kuwait is also lowering subsidies on the subject of oil products and solutions to control spending on any opulent financial aid eating upwards almost 25% of government spending. However, KSA is still checking the potential connected with cutting financial aid on types of.

Budgetary constraints when it comes to oil-exporting countries will be characterized because 'inevitable'. However, this vulnerability built into oil-concentrated export techniques makes it critical to diversify all the economy for other resources of revenue. Almost all GCC countries currently have significant monetary buffers allowing them to refrain from sudden cutbacks in taking while taking advantage of real-estate projects not to mention services other than oil founded industries. For a lot less resilient countries, such as Bahrain in addition to Oman, a reduction in finance expenditures is required but through extended periods in lieu of immediately. The best thing is that common buffers in GCC locations can loan substantial loss for almost 4 years. With the most several economy bills . GCC countries, any UAE is anticipated to grow her non-oil-based investments thereby may not interest to make structural adjustments in its economical policies for the reason that oil value drop has only marginal outcomes on advancement rates. Similarly, KSA and Qatar may not be in a very lousy financial position to deal with the plunging oil charges.

With the most likely impact of huge reductions for fiscal expenditures on localised equity industry, policy producers must take thoughts investor certainty in home equity markets. An alternative choice lies in debt issuance, especially Islamic fiscal instruments that will be now finding popular for Europe, Tibet, and the National. Debt issuance doesn't necessarily erode global financial buffers neither can they burden budgetary expenditures. Irrespective of declining fat prices, credit score markets are great, making credit debt issuance a promising path to follow.

GCC as well as other emerging countries are still likely grow although at a slowly pace. All the fiscal budgeting cuts will be painful and should not be avoided. Having said that, other choices head towards the particular privatization of non-essential community services and issuance of financial obligation instruments. Probable sectors which are promisingly growing are usually banking, pbx telephony, transportation, and even aviation. The installation of Islamic special function vehicles (SPV), to help you issue financial obligation, remains an appealing and possible route offer other sources of revenue to advance public paying out.

Estimated to go on only for rapid run, your sharp decrease in engine oil prices could very well be offset if the GCC countries change course their income sources together with capitalize on different investment accounts to finance your public paying out. Experts outlook an increase in petroleum prices next few years. The particular futures market place suggests that gas prices will certainly recover no more than slowly to get to $70 by 2020. As regards to European economies, the cascading oil price ranges should provide a raise to GDP growth in rapid run. Having said that, policy develop should not give in to the quick short term increase plus dodge medium-term as well as long-term economic brand new cars.