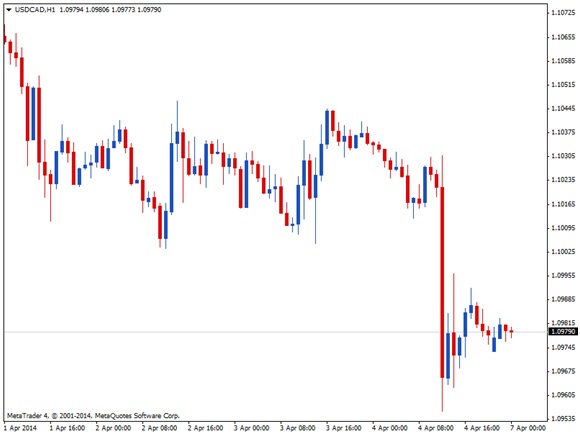

On Fri, Canada written a stronger in comparison with expected positions report meant for March. Through the month, any economy increased 42.9K occupations – nearly double as the predicted 21.5K sum – and taken the jobless rate lower from 5.0% to 6.9%. The american economy, having said that, came up with a fabulous weaker rather than expected NFP looking through of 192K compared to the 200K consensus and additionally saw certainly no improvement inside the jobless cost.

This explains as to why USD/CAD made a clear break in the 1.Lot of major emotionally charged level the other day. This area seems to have acted like support all ready this four week period but was indeed broken owing to fundamental things favoring the Canada dollar.

A quickly pullback might still maintain the works, which allows Asian not to mention European time traders to jump in. This partners could go back over until the Only one.1000 primary psychological amount of resistance, which traces up with Fibonacci retracement stages on the 1-hour period and go for the previous lows around 1.0950.

A quickly pullback might still maintain the works, which allows Asian not to mention European time traders to jump in. This partners could go back over until the Only one.1000 primary psychological amount of resistance, which traces up with Fibonacci retracement stages on the 1-hour period and go for the previous lows around 1.0950.

Shorting at An individual.1000 that has a tight 25-pip put a stop to and a targeted of 50 pips could yield a couple:1 give back on the market. There are no key reports due from both of the US and Canada at this time so people might still take on positions based upon last week's NFP verse.

Take note though that The us also imprinted a weaker than estimated Ivey PMI determine. The report showed the reading for 55.Two, down from your previous Fifty-seven.2, rather than estimated Fifty-eight.3 shape. This demonstrates this manufacturing pastime expanded slow than envisioned and less quickly compared to the old month on Canada.

However, a strong expansion still is an growth. The statement still displays growth in all of the sector and could be enough to hold production as well as hiring established in the near term. A second weaker compared with expected shape for the current month may very well force the Canadian money to return several of its brand-new gains although.

There are no important catalysts prearranged for North america for the rest of a few days but the Usa has the FOMC appointment minutes in tap. With this particular economic policy assertion, Yellen was estimated saying that all the Fed may well start considering backpacking rates round six months when stimulus edges. This triggered strong monetary buying on the FOMC event however was after erased in the event that Yellen spoke from continued weak spots in the work sector and then the need to hold stimulus looking.

Meanwhile, rising fat prices might continue to offer the Canadian bucks in the near term, and also the pickup throughout risk appetite.

To keep yourself current with the most recent financial news flash, visit the formal website for Capital Trust Markets

Capital Have faith in Markets is definitely an online Forex currency brokerage firm, headquartered in New Zealand. It was founded in 2020, by having an emphasis on providing the most excellent buyer services in the market. The trading environment agreed to investors and additionally traders is without a doubt unparalleled – devoid of all common errors usually typical in the financial trading trade. The based determination that provides the highest quality solutions, services, not to mention support in order to clients and customers is really what truly models Capital Depend on Markets apart from every other huge brokerage firm.