Algorithmic trading has developed increasingly popular recently as computer system processing expenditures have dropped and the option to automatically insert transactions within a fraction of any second is actually commonplace. And not having commentators pouring finished news provides nourishment to or tables to decide on a trading strategy just as events happen, complex formulas are now greatly deployed – any parameters are positioned in advance together with the computer simply just executes the best trade being the events take place. It's truly worth adding the fact that isn't interesting facts about High Volume Trading (HFT) whereby some search out repeatedly guide small income on many trades day-to-day. Automated dealing strategies could equally be used to de-risk positions mainly because significant happenings are unfolding, become those significant factors for example a profit warning or economical release, or even just as a respond to technical stages being breached.

Institutions as well as private investors will expend a great deal of aid on guaranteeing they have a computerized strategy that work well. Rigorous back-testing can be perfectly frequent to ensure that that winning trading outnumber all of the losing models, but it is some sort of widely taken fact throughout finance which usually without variation, you run various significant challenges. No pay for manager would definitely ever have some sort of portfolio comprising just one stock options, so in just the same way, algorithmic professional traders should always be operating multiple trading systems at the same time along with exposure to many different instruments. This provides the assurance that when one 'algo' isn't able due to a number of unexpected state of affairs, the stock portfolio as a whole continues to have value and you could continue to deal. This is most of sound pondering when you are utilising physical means, but if you want to trade on the leveraged foundation then it gifts some specific challenges.

Leveraged stock trading is very common, specifically physical delivery of the assets will not be required. Additionally it is useful for shorter term trading plans as operation costs are typically lower. It sees this investor settling down half the normal commission of the business value simply because collateral having the ability to get far more exposure to typically the asset, even more improving the potential return on investment. Still, when taking this approach, the or capital manager must ensure they've already sufficient free margin available for all of the currency trading strategies, which can be in engage in at any person time, to draw in on as soon as the need happens. Each individual investment will be regulated by a tailor-made algorithm, but you always need to have sufficient space designed for draw off if one – if not more – aspects of the particular portfolio typically are not performing since you had planned.

So here lies the dilemma – influence is widely useful for which allows the individual to work his / her available income harder, but once that same individual needs to abandon hefty tranches of greenbacks on pay in with the adviser just in the event it's required to have a draw down, then the highly benefit which will leverage allows is drastically changed. Once you incorporate diversification within the equation, it might be even more complicated. Except in cases where investors can locate a way to all at once back-test multiple investing strategies from a single cash account, consequently trying to choose just how much mark up is required along a different, algo-based trading strategy – or alternatively how you can optimizing like strategy in the cash that's available – has until now been not possible.

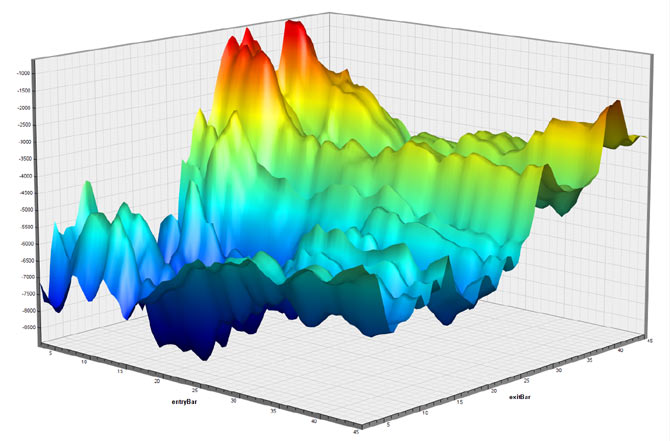

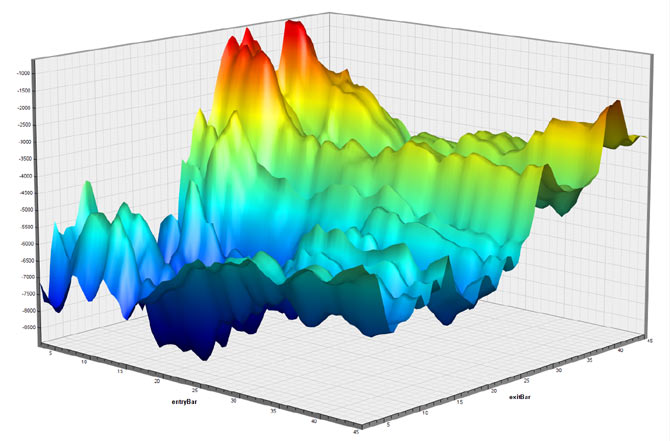

Companies such as Seer Currency trading have nevertheless been attempting to find a solution for this challenge and they've now formulated an institutional grade algorithmic trading principle that is utilised by a number of loan companies and secret trading residences for multi asset and then cross advantage trading tactics. This growth in the examining and cure for algorithmic trading can be regarded as pushing colleges, money directors and private businesses one step closer the goal of reliably achieving better returns whereas minimizing chances. Key to they have been being able to display the outcome of the back-testing from a three dimensional heat-map, providing the very likely problem areas that should be identified in no time. Ultimately the purpose is that the dollars manager can re-work the strategies inside play to get rid of this associated risk, rather than merely having to improve the entire cash stored in the finance.

.

Of course in spite of how sophisticated and even robust typically the back-testing process is normally, the ultimate achievements of the fx trading strategy will invariably come back to the way intelligent the particular algorithm is. As computer costs continue to fall and control speeds maximize, the stats programmers as well as quant analysts will go on having the capacity to refine the models, estimating future total price behaviour having ever- increasing clarity. There is little uncertainness that this is where the war for alpha returns shall be fought from the months along with years which will lie on top.

About the Author:

Ilan Azbel is often a Director for Seer Trading (online world.seertrading.com). Fresh over Fifteen years of experience top technology, above 10 years expertise in financial markets, along with an academic back ground in arithmetic and information technology. Ilan is a key strategist and experienced for the growth and victory of suppliers which he becomes involved in. Your dog founded Autochartist found in 2003 which contains become the single most popular intelligent pattern popularity solutions for retail forex traders worldwide that is looking to recurring this achieving success with Seer Forex trading.